Lisa had lived in Austin her entire life and had just re-opened her family’s BBQ Restaurant in 2019. Although the restaurant had been closed for a few years, it still was largely remembered as a staple to the community.

Lisa opened the restaurant in a new location and as expected the local fame of her family name caused business to sky rocket. Quicker than she could have imagined. In order to keep up with the influx of business she needs to hire additional employees and buy more inventory than her current cash flow allows.

If she doesn’t streamline the process in time, her business could be crippled by Google reviews and online ratings claiming her wait time is too long, or that they are always out of their famous ribs.

She knows this time next month she will have the money. But what are her options in the meantime?

She could go to a bank and ask for a business loan.

But a bank loan will take up to 3 months to be approved. Requiring hundreds of documents, hours of Lisa’s time, and only a 20% chance that she will even be approved.

So what other options does Lisa have?

Lending automation.

On a lending automation site Lisa can be approved for a small business loan with a single click of a button.

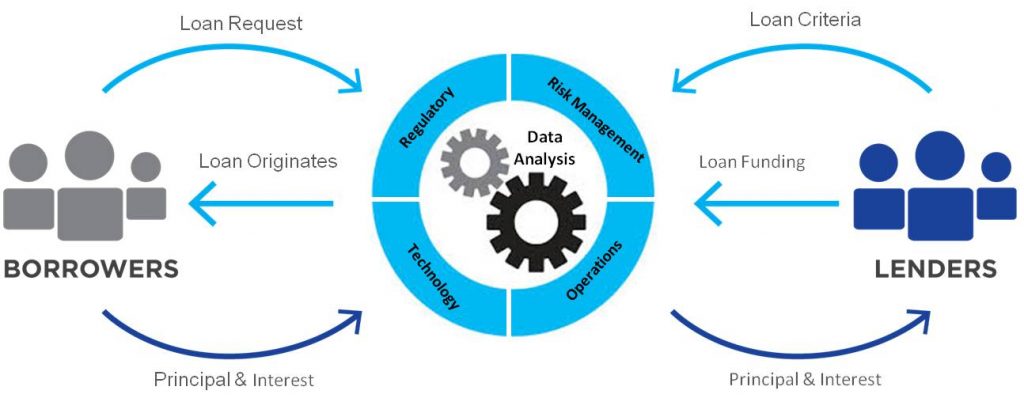

On the back end of these lending automation programs is an algorithm that provides a quick answer for the business owner looking for a loan.

The lending software in minutes can analyze financial indicators such as growth and customers, and then determine how much money they can lend out, and how long the business owner will likely need to pay it back.

And not only can lending software automatically create a feasible payment plan, with lending automation percentages of each sale can automatically be deducted to pay off the loan.

This bypasses the usually lengthy process borrowers are forced to go through when they apply for a typical small business loan.

If it wasn’t for lending automation, Lisa’s dream of reviving her family’s restaurant likely would have crumbled. Instead she was able to get the funds she needed to hire new employees and buy the equipment that she needed.

Looking to schedule a demo or learn more about LendSaaS? Click here for a free demo today!

Leave a Reply