LendSaaS is hand down the best MCA software on the market that can aptly take care of your MCA business. LendSaaS has been hailed as the most versatile and more consumer-friendly than contending MCA programs (such as MCA Suite).

What Is Merchant Cash Advance, aka MCA?

Merchant cash advances are used to pump funds into firms that are experiencing a cash flow problem or are on the verge of going out of business.

Despite being one of many alternative working capital finance options on the market, it continues to be the forerunner in giving business owners some much-needed breathing room when it comes to instant liquidity.

This relieves business owners of the pressure to fulfil a daily sales target in order to meet repayment obligations. In a different scenario, the borrower repays the loan in equal daily or weekly instalments depending on projected revenue.

Since charging a fixed amount based on expected revenue eliminates the need to monitor payments, this scenario is easy to implement in merchant cash advance software

.

Smaller businesses can get a cash advance in lieu of a daily percentage of their debit or credit card sales from merchant cash advance lenders.

The amount to be withheld is not predefined, but the percentage is. This relieves business owners of the pressure to fulfil a daily sales target in order to meet repayment obligations. In a different scenario, the borrower repays the loan in equal daily or weekly instalments depending on projected revenue.

Because charging a fixed amount based on expected revenue eliminates the need to monitor payments, the plan is easy to implement in merchant cash advance software.

About MCA Software

To develop a solution that effectively balances portfolio risk and scalability, Merchant Cash Advance, abbreviated as MCA Software, considers the critical integration requirements with payment processors, management of underwriting and payback, and user account portals.

The MCA software is collaborative, supports many workflows, allows for real-time decision-making, and is an end-to-end digital channel that expedites and closes more deals via submittal, underwriting, funding, and payback.

The program is usually powered by a low-code modular architecture that permits a high degree of reusability and customizing to create solutions tailored to specific business needs.

Use the potential of bespoke omnichannel contextual experiences to strengthen your client relationship.

Picking the best MCA Software | What makes LendSaaS stand out

LendSaaS is the finest MCA software available for your MCA business. It has been hailed as the most versatile and more consumer-friendly than competing MCA programs (such as MCA Suite).

Here are a few reasons that make LendSaaS a worthy winner.

Integrations Galore

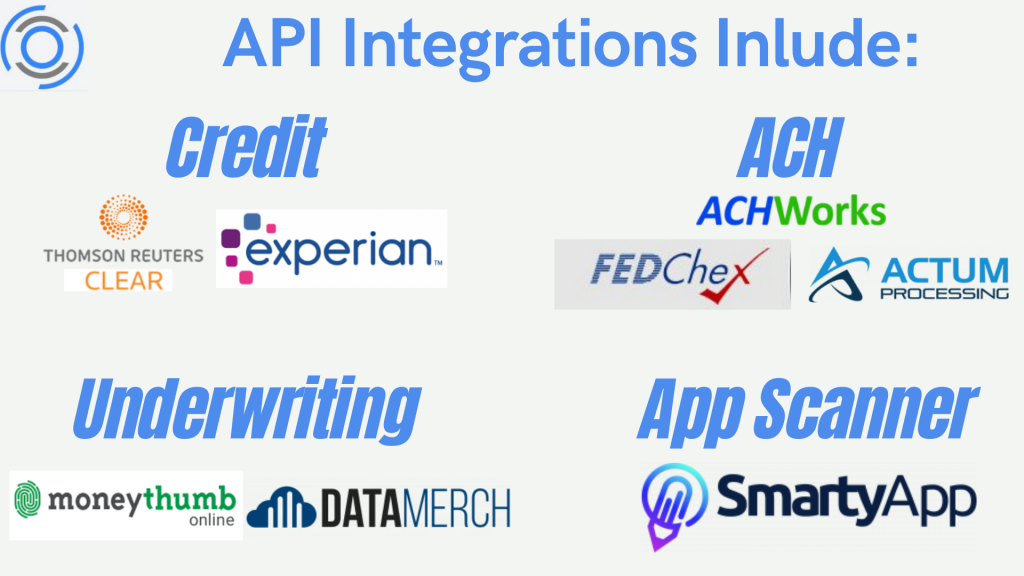

With a wide assortment of integrations accessible and more in the pipeline, it is safe to say that LendSaaS will always have the integrations you need to support your MCA business to scale new heights. Further, their coding team is committed to adding more as time goes on, particularly when clients ask for it.

Unlike MCA Suite and other MCA software, LendSaaS is the only one continually evolving- Something critical in such a rapidly changing industry. No wonder it is the best option accessible to the entrepreneurs of today.

Prominent Integrations On LendSaaS

- Experian

When it comes to running background credit checks, Experian continues to be the most trustworthy LendSaaS powered MCA program out there.

You may use Experian with complete assurance to do background checks on potential borrowers.

- Decision Logic

In the Merchant cash advance industry, Decision Logic is one of the most reliable underwriting solutions available.

Never be unsure about a borrower’s trustworthiness again. The smart banking software from Decision logic looks for any warning signs online and in real-time.

- DataMerch

Funders can use DataMerch to automatically identify if a potential client’s alternative lending record has any warning signs that need to be looked out for.

You have the option of setting your own parameters or adhering to pre-determined approval criteria.

In either case, combining DataMerch with LendSaaS will save your MCA company a substantial amount of time in the underwriting process.

Leave a Reply